I am still holding on to my position, and will add more on dips.

AMPS 0.00%↑ has been hovering between $4-$7 range for the most of 2023 despite delivering on its guidance in this tough interest rate environment. It has shown no signs of slowing down as compared to its peers in the solar sector that have been missing guidance and getting destroyed from the business aspects - eg. NOVA 0.00%↑ ENPH 0.00%↑ , SEDG 0.00%↑.

2023 Highlights

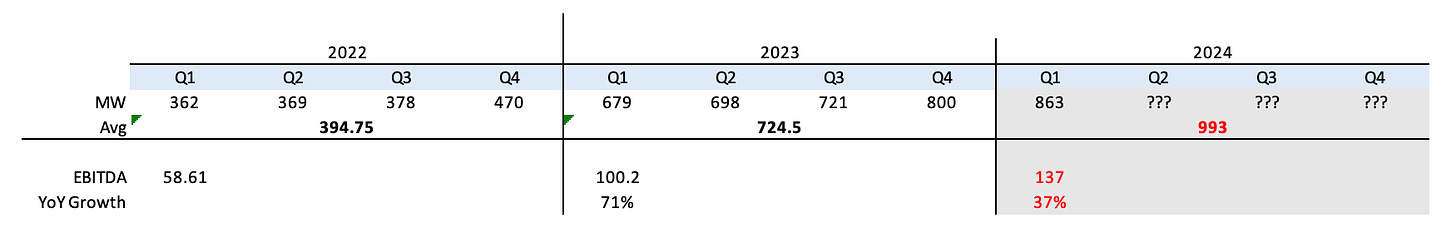

Grown asset portfolio from 470MW in 2022 to 721MW (Q323) with an additional 143MW of coming online by Q42023. This brings up the portfolio to 863MW; 83% YoY growth.

Maintained high operating margins at 60%, despite being in a higher cost of borrowing environment.

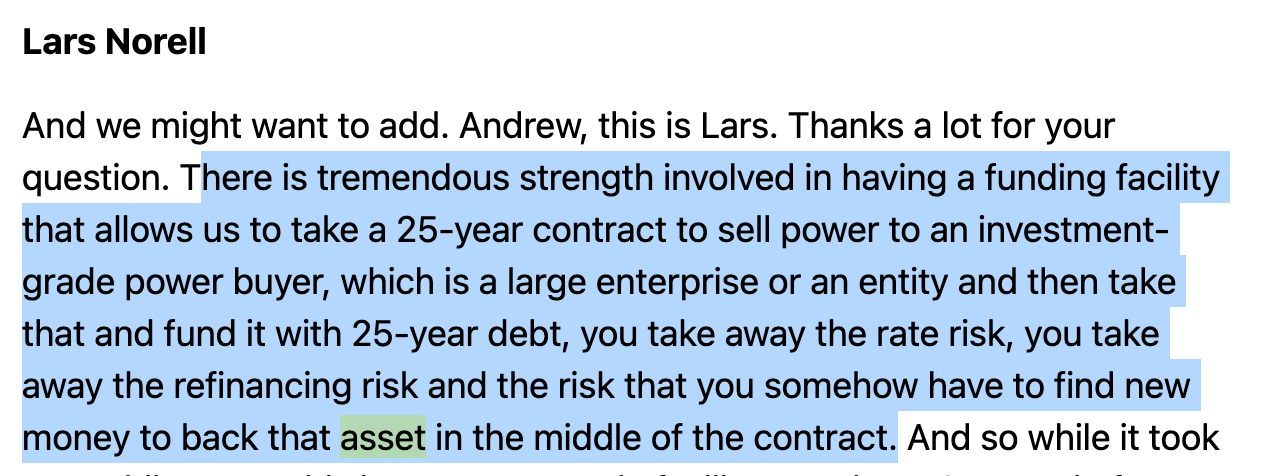

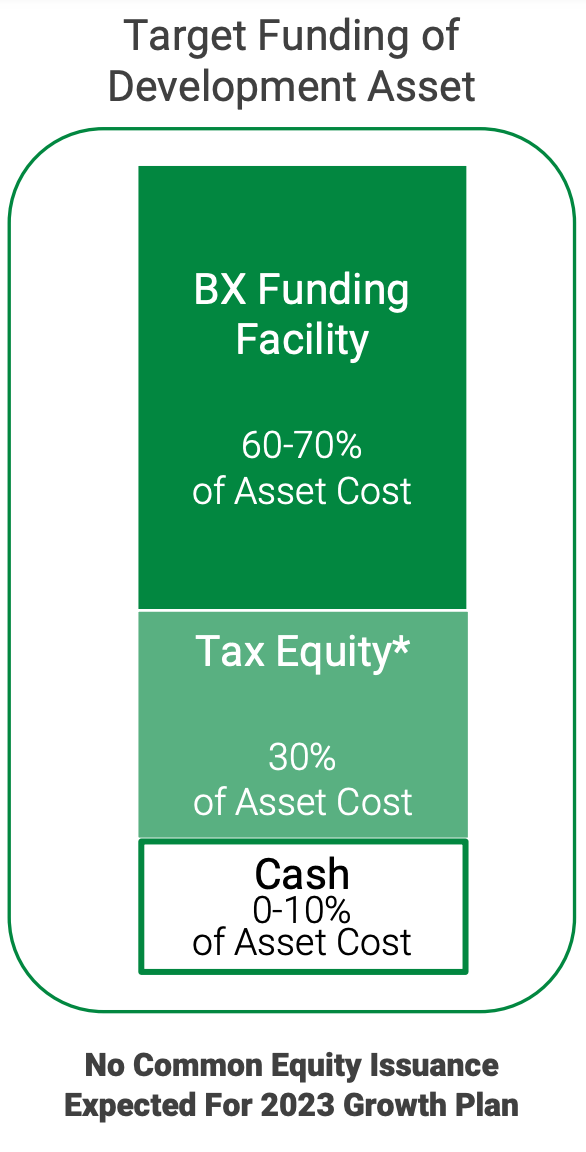

First in kind non-bank syndicated construction facility with Blackstone insurance capital. This facility is important because most solar asset companies like Altus have large debt balances as they take on all upfront installation costs of solar panels for their clients. This exposes them in a high interest rate environment, especially since the lifetime of a solar panel is 25 years which is results in refinancing risk as not many debt have fixed rates for such a long duration. By securitising the debt and packaging it off as a 25-year fixed income product to BX insurance, Altus locks in the margin at the point of sale and protect it versus its competitors even in a high borrowing cost environment, which allows it to maintain its high margins.

Altus’s funding structure for new installation is very lean - allowing continued growth. Only 10% of cash required from Altus and the rest are raised through BX + Tax Equity Credits.

3 most important things I am looking out for in 2024:

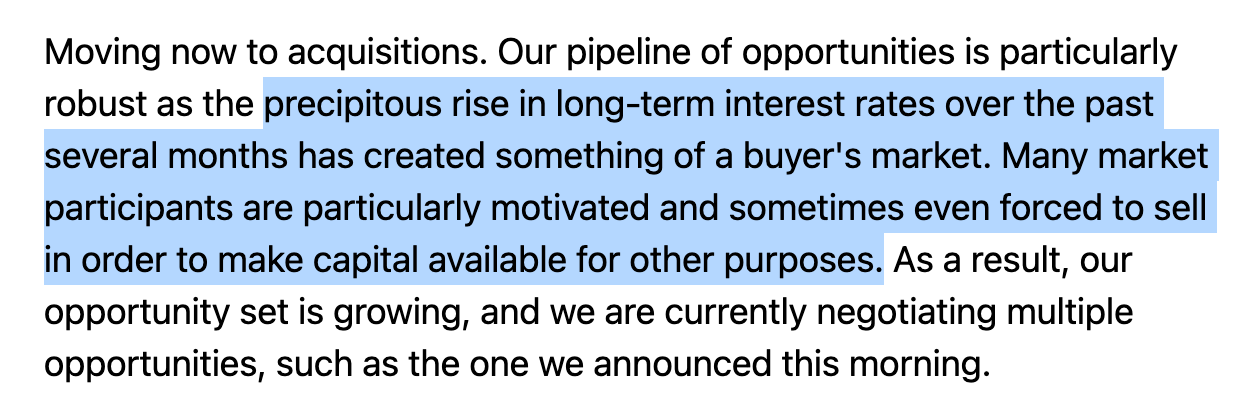

More acquisitions of solar assets to hit a portfolio size of 1200-1300MW by year end vs 993MW in analyst estimates. In my opinion, large acquisitions are the fastest way to grow the asset portfolio which in turn leads to the largest increase on bottom line growth. During the latest CEO interview, Gregg mentioned that many small family offices/PE firms are trying to exit their solar assets that were built for the tax credits initially, while others are simply pivoting out to allocate capital in other areas. My hope is they manage to finalise 1-2 more large acquisition to grow their portfolio at an accelerated pace.

See below, comments by co-CEO Gregg:

Continued integration of community solar/EV charging/battery integration, especially in densely populated areas. (currently only 25% of 721MW of asset) Right now all the excess power generated is sold back to the grid at wholesale and utility scale prices which understates the true margin at 100% retail price levels. Improvements on this will be hugely beneficial for further improving margins.

While AltusIQ is still in the early in-roads, some visibility on how they will monetise this will be encouraging as it adds on new optionality to business profit growth and upselling of the product suite it is currently offering to its clients.

Valuation:

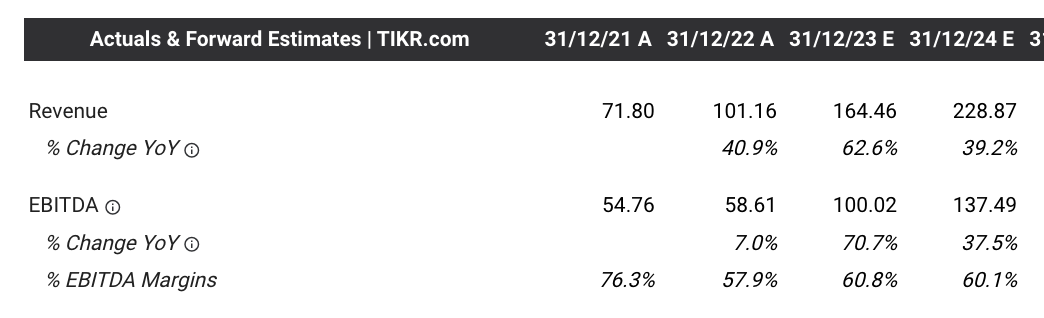

Current estimates are suggesting that EBITDA guide for 2024 is at 137.5m which is an average asset portfolio of 993MW for FY24.

If they manage to secure 1 or 2 more 100-200MW acquisition early on in FY24 (which I believe is possible from the earnings transcript + latest CEO interview is) FY24 EBITDA estimates could guide upwards to 1200/993 x 137 = 165m vs 135m

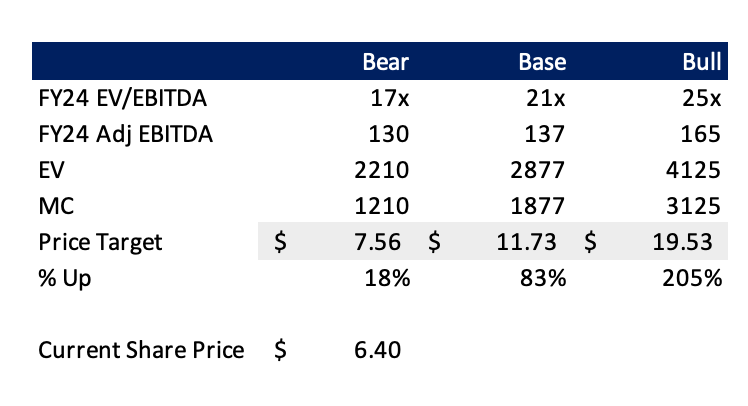

The lowest FY23 EV/EBITDA was around 17x in 2023 when share price bottomed around $4.15. We saw big buying from the Co-CEO Greg at that price.

For my valuation, I used historical multiples in 2023 as a guide for future price expectations. This gives us a multiple range of 17-25x FY24 EV/EBITDA which is reasonable for a company expected to grow top line upwards of at least 30% YoY with EBITDA margins of 60%. The recurring nature of cashflows on 20 year contracts with customers that are recession proof (people use electricity regardless) also demands a premium vs businesses with discretionary demand nature. Lastly, an improving interest rate environment after the latest fed guidance for rate cuts in 2024 might lead to multiple expansions especially within the solar stocks basket that AMPS is part of.

Final Thoughts

At current prices, I am comfortable with Altus sitting around 10% of my portfolio. I will continue to increase my position to 20% of my portfolio if prices drop below <$5.5 and increase my position further to 30% sizing if I get a chance below <$4.5 again - unless the thesis changes

I will hold this position and only take some profits on my core position once it hits fair value around $11-12 unless FY23 guides upwards vs the 137m EBITDA numbers. Will be looking forward to next Quarterly report in Mar 2024 and get more colour on the FY24 guidance and roadmap for their solar portfolio growth.

For those who hasn’t listened to this podcast, I highly recommend spending some time to watch it to have a better picture of the business and the opportunities that lies ahead for this company.

Love how u broke it down in simple layman terms for people like me ☺️