Kinsale Group ($KNSL)

A valuation reset on a Niche Market Leader in the E&S Market

Ticker: KNSL 0.00%↑

Market Cap: $7.75 billion

Price: $334.52 (28 Dec 2023)

Merry Christmas and Happy New Year to my readers. Wishing everyone a cozy time with your loved ones. If you’re wondering why I’m writing over the holidays, my partner is spending the holidays with her family in Japan so I had some time on my side.

Executive Summary

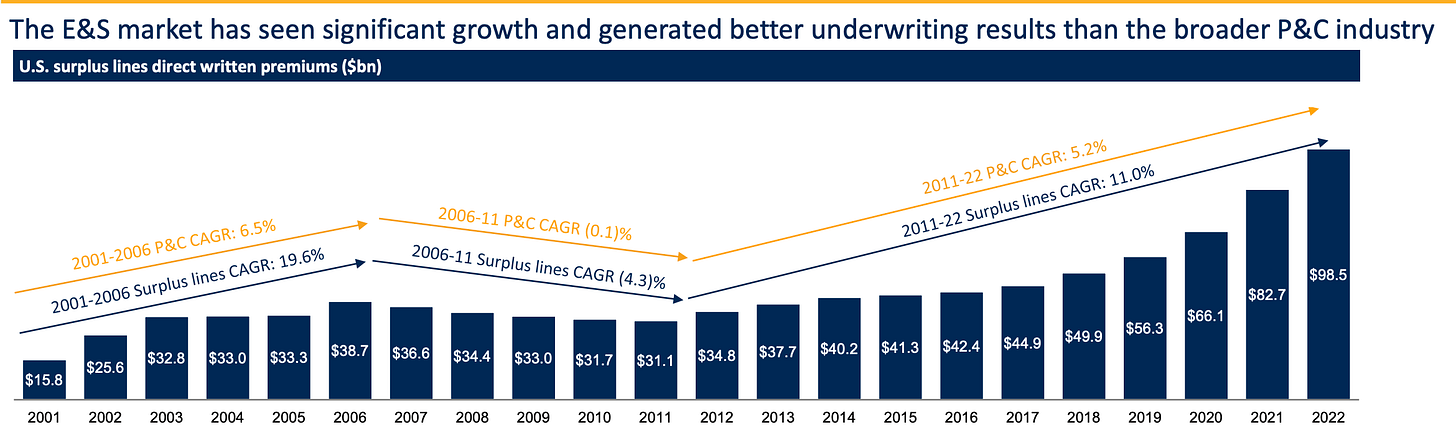

Kinsale Capital group is the only publicly-traded pure-play excess and surplus lines (E&S) insurer in the United States. The E&S specialty insurer has enjoyed exceptional returns since 2016, with industry leading combined ratio, prudent credit quality and return on equity metrics. Over the past 4 years, it has grown underwriting premiums at a CAGR of 40%, $390m in 2019 to an estimated $1.5 in 2023.

The primary concern for KNSL was never about the business quality but in its rich valuation of LTM 40x-45x P/E and 10x P/B. With the recent 26% drawdown after Q323 earnings, it provides an attractive entry point to enter a quality compounder at LTM 28.5x P/E and 8.35x P/B. While this is way above the insurance industry average 10-20x P/E and 1.5-2x P/B, KNSL is a pure-play E&S player that has better margins vs standard P&C insurers. Within the E&S industry (eg. Progressive, RLI, Global Indemnity Group and James River group), they trade closer to LTM 20x P/E and 4-5x P/B, but are of significantly worst quality than Kinsale.

I believe that buying KNSL 0.00%↑ at current price ($335) provides an attractive opportunity to own a quality E&S insurer at a forward IRR of 10-20%~ for the forseeable 3-5 years.

Business Overview

In the insurance business, there is 2 main groups - Health and Life insurance and Property and Casualty (P&C) insurance. Excess & Surplus lines ("E&S") is a specialty market or subset under the P&C insurance market which specifically insures things standard carriers won't cover. Think of E&S as 'non-prime' when it comes to the insurance market, where 'prime' insurance is standardised risks that major carriers will underwrite.

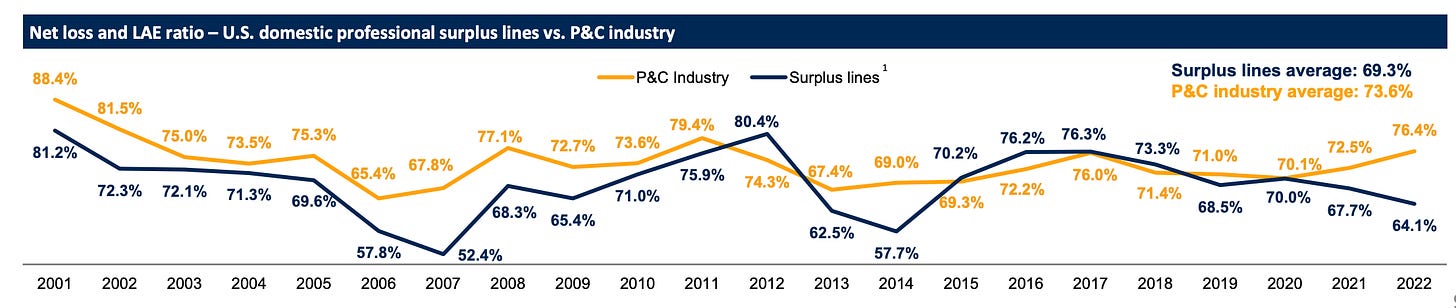

E&S insurance tends to have better underwriting results than the P&C industry, with average loss ratio of 69.7% vs. 73.5% for the P&C industry. This is because E&S risks are those that the standard carriers have rejected, hence pricing tends to be better than standard risks.

A typical E&S sales process usually looks like this:

Customer goes to their P&C insurance broker to ask for a specific P&C coverage.

As customers request is non-standard, their broker will go to a wholesale broker (eg. Ryan Specialty) to ask for a non-standard underwriting

Wholesale broker submits this policy details to a number of E&S underwriters eg. Berkshire, AIG, MKL, Kinsale etc.

Eg. Kinsale (E&S provider) reverts back to the wholesale broker with their proposed underwriting terms and if agreed with the customer, deal will close and underwriting premiums goest to Kinsale

Claims will be paid out accordingly, should there be any losses over the duration of the coverage period

Kinsale underwrites business in all 50 states and territories in the US using a network of independent brokers. Kinsale writes a variety of business, with no single business line comprising more than 17% of total gross premiums written. It has only around 1-1.5% market share in a $100b~ E&S market, with the largest players being Berkshire, AIG, MKL.

Kinsale focuses on the small-medium sized risks (around 75% of its underwriting) that big players are not focusing on. Average annual premium per customer is around slightly below 15k as compared to the larger E&S players where average premium can be 10-15x more.

As these coverages for hard-to-place small and mid-sized business risks are less saturated, loss ratio is much lower than industry averages. On average, they get paid $1 in premiums for every 60c of risk - sign me up! (Average loss ratio is between 50-60% vs 60-75% in the P&C and E&S industry)

Loss ratio % = Total claims that have been reported to the carrier, plus the carrier's costs to administer the claim handling, divided by the total premiums earned

An anology to look at loss ratio for insurers is basically an “inverse” gross margin ratio. The lower the loss ratio, the higher your “gross margin” from your underwriting profits.

The Opportunity: Why the drop?

The huge drop was much overdue and the market is finally re-rating Kinsale valuation multiples to that of a company growing closer to a 20% clip instead of the 40% YoY it has achieved over the past 4 years.

The E&S pricing environment has slightly come off its peak, and economic softness in the construction and real estate markets might have led markets to forecast a slowdown in underwriting growth rates.

Nonetheless, it has been reinforced by the management team that the pricing environment is still very favourable, with business lines flowing into the E&S lines especially on the casualty insurance side of the business.

Personally, I liked that the CEO constantly tries to moderate the market expectations on what is sustainable, and what is realistic. It is also very evident from their comments that Kinsale will never prioritise growth at the expense of taking on bad risk. Ultimately, the insurance industry is a market where you have to play offense when the time is right and hold back when pricing is not favourable for the risk you put in the books. To put things into context, TWGP and AFSI underwrote underpriced businesses for several years to show great growth numbers which looked really good to investors initially but eventually, reality hit which killed them when they were unable to service the claims.

One positive thing to note is that we can expect higher investment income from their float which will bring higher investment income over the next few quarters. With a $2.6 billion float, every 1% interest rate increase is an additional $20m in investment income, which is almost 10% of its LTM net income.

The big question: Is this drop justified?

While it is always difficult to pay a fair/slightly expensive price for a business, there are many unique intagibles for Kinsale’s case that makes it worth owning..

There is an amazing podcast by Shree, portfolio manager of SvnCapital (link attached below) who dugged deep into the qualitative aspects of the business and the competitive advantages behind its superior growth and profitability.

It boils down to 3 key factors:

Exclusively focused only low-mid sized E&S which has the highest margin with least competition vs larger E&S accounts or vs standard P&C insurers

Lowest expense ratio of around 20% driven by technological edge, streamlined claims process and competitive acquisition ratio (15%, compared to the industry's 17-20%). Main office is based in Richmond Virginia vs New York, lower rent etc.

Extremely qualified, owner/operator management team who has been there from the beginning that have successfully navigated through difficult casualty markets/ COVID with combined ratio at low 80s even after Hurricane Ian in 2022

Kinsale’s focus on the small-mid size clientele is a smart strategy as they are not competing head on with the big legacy guys who are more focused on the larger clients. This is also in part due to the fact that big guys are still using very outdated legacy systems from 10-20 years back and hence, they need to focus on the larger businesses and clients as they are not nimble enough to handle all the small and non-standard E&S request.

This makes Kinsale the dominant “monopoly” among smaller discolated players as they have superior softwares that can predict/analyze hard-to-place risk which smaller firms lack. Operational efficiency with <24 hours turnaround time when responding to a policy request submitted by a wholesale broker. Being “larger” in the small-mid E&S market allows lowered broker fees 15% vs 17-18% commissions. Being a big fish in a small pond (small-mid size E&S market - most profitable segment) with these competitive advantages adds up over time and forms a moat in a niche subset of the E&S market.

On the view of a softer market insurance, the cyclicality of the insurance market is usually a long drawn market where a few factors have to come into play before the market reprices risk and E&S market pricing sees a cool down.

Catastrophe rates have to go down for extended periods

Social inflation rate has to go down,

Interest rate have to go down for financial capital to flow back in,

Economic weakness in the commercial and real estate sector

If you are planning to hold Kinsale for the longer time horizon, this shouldn’t matter too much as the business continues to consolidate its foothold in the small-mid size E&S market. The E&S market growth is healthy and from the past 4 years of stellar execution, I trust in the management’s ability to play offense and defense at the right time to maximize earnings over the longer run.

Valuation

While Kinsale has been growing its revenue and net income by >40%, I am trying to taking into account a very soft market environment where growth slows down. This also leaves room for buffer in case of any consecutive catastrophic events in the coming years which will increase loss ratio.

Even when dropping growth rates from 40+% to 15%, and slashing historical P/E multiples by half to 21x LTM P/E multiple, the current market price is still trading below my bear case price target $372.

I have initiated a base position with an average price of $336 and will consider adding some LEAPS if KNSL 0.00%↑ continues trading down another 15% to around $285 or 24x LTM P/E. My plan is to let this position grow and prove itself overtime if it wants a larger portfolio %. I personally believe that 20% growth is achievable for Kinsale and see a forward IRR of around 15% even if market does not re-rate the P/E multiple back to the historical averages of 40-45x P/E and it stays as a 29x P/E stock.

Exit condition is if I start seeing more and more signs pointing towards a soft market for longer already early into 2024 as that will probably mean my bear case scenario of growth slowing to 15% being more likely to play out.

If you enjoyed this article, make sure you’re subscribed here on substack so you don’t miss future content. Consider following me on Twitter as well @limhongyu, where I post timely market-related content on my portfolio holding

Appendix

Podcast Link:

https://podcasters.spotify.com/pod/show/graham-rhodes/episodes/Shree-Viswanathan---Let-The-Process-Lead-You-e2ajiuj

(forgot to mention)

... I saw weeks ago this on YouTube:

Dec 3, 2023

Michael Kehoe, Chief Executive Officer and President of Kinsale Capital Group, Inc. speaks at the 30th Annual Baron Investment Conference

--- A great impression, very useful hearing his presentation ---

(forgot to mention)

... I saw weeks ago this on YouTube:

Dec 3, 2023

Michael Kehoe, Chief Executive Officer and President of Kinsale Capital Group, Inc. speaks at the 30th Annual Baron Investment Conference

--- A great impression, very useful hearing his presentation ---